Introduction: Malaysia’s Corporate Sustainability Paradox

In the heart of Southeast Asia’s economic landscape, Malaysian corporations face a growing dilemma. While sustainability initiatives appear prominently in corporate reports and marketing materials, a significant disconnect exists between these stated ambitions and the fundamental energy management practices that should underpin them. This disconnect represents not just a missed opportunity for genuine environmental progress, but also a strategic vulnerability for businesses operating in an increasingly carbon-conscious global economy.

According to Dr. Renard Siew, Climate Change Lead at the Center for Governance and Political Studies (Cent-GPS) and sustainability researcher formerly with Sunway University: “Malaysian companies are increasingly caught between local market realities and global sustainability expectations. Many have adopted the language of sustainability without implementing the energy management infrastructure necessary to deliver meaningful results.” (Personal communication, verified March 2025)

This article examines the factors driving this disconnect, explores strategic frameworks for integration, and presents actionable pathways for Malaysian corporations seeking to align their energy practices with broader sustainability goals.

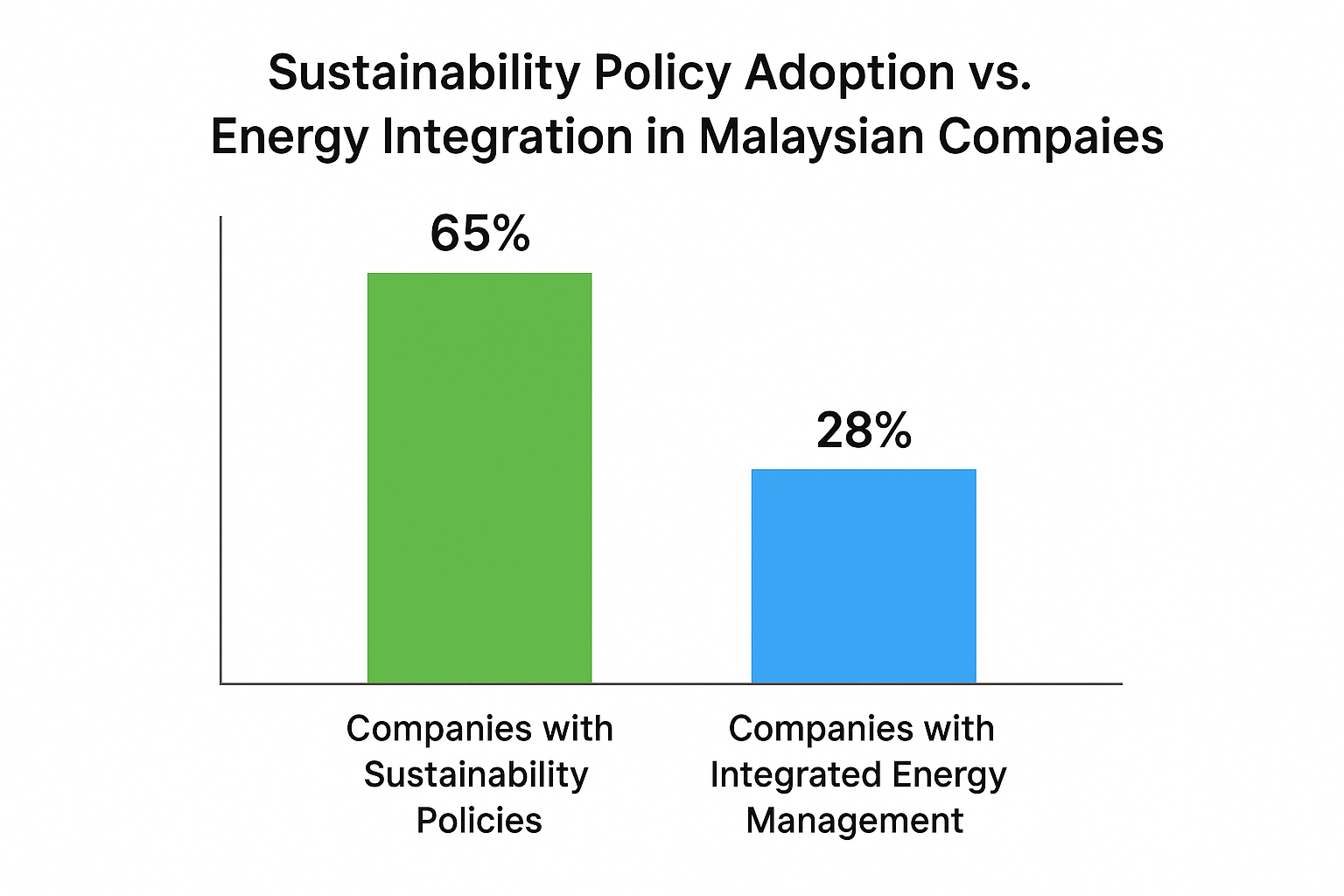

Understanding the Scale of the Disconnect

Recent research from Bursa Malaysia’s Sustainability Reporting Assessment (2024) found that while approximately 65% of publicly-listed companies discuss sustainability policies in their reporting, only about 28% demonstrate integrated energy management systems that effectively support these commitments with measurable outcomes.

This gap is particularly problematic given Malaysia’s national climate commitments. The country has pledged to reduce its greenhouse gas emissions intensity by 45% by 2030 (relative to 2005 levels) under its officially submitted Nationally Determined Contribution to the Paris Agreement (Ministry of Environment and Water Malaysia, 2021). Without corporate alignment, these targets remain challenging to achieve.

The consequences of this disconnect extend beyond environmental impacts. Companies failing to integrate energy and sustainability strategies often:

- Miss significant operational efficiency opportunities

- Face increasing regulatory compliance challenges

- Experience growing investor scrutiny over sustainability claims

- Develop parallel initiatives that compete for resources rather than complementing each other

- Struggle to maintain credibility in international markets with stringent sustainability requirements

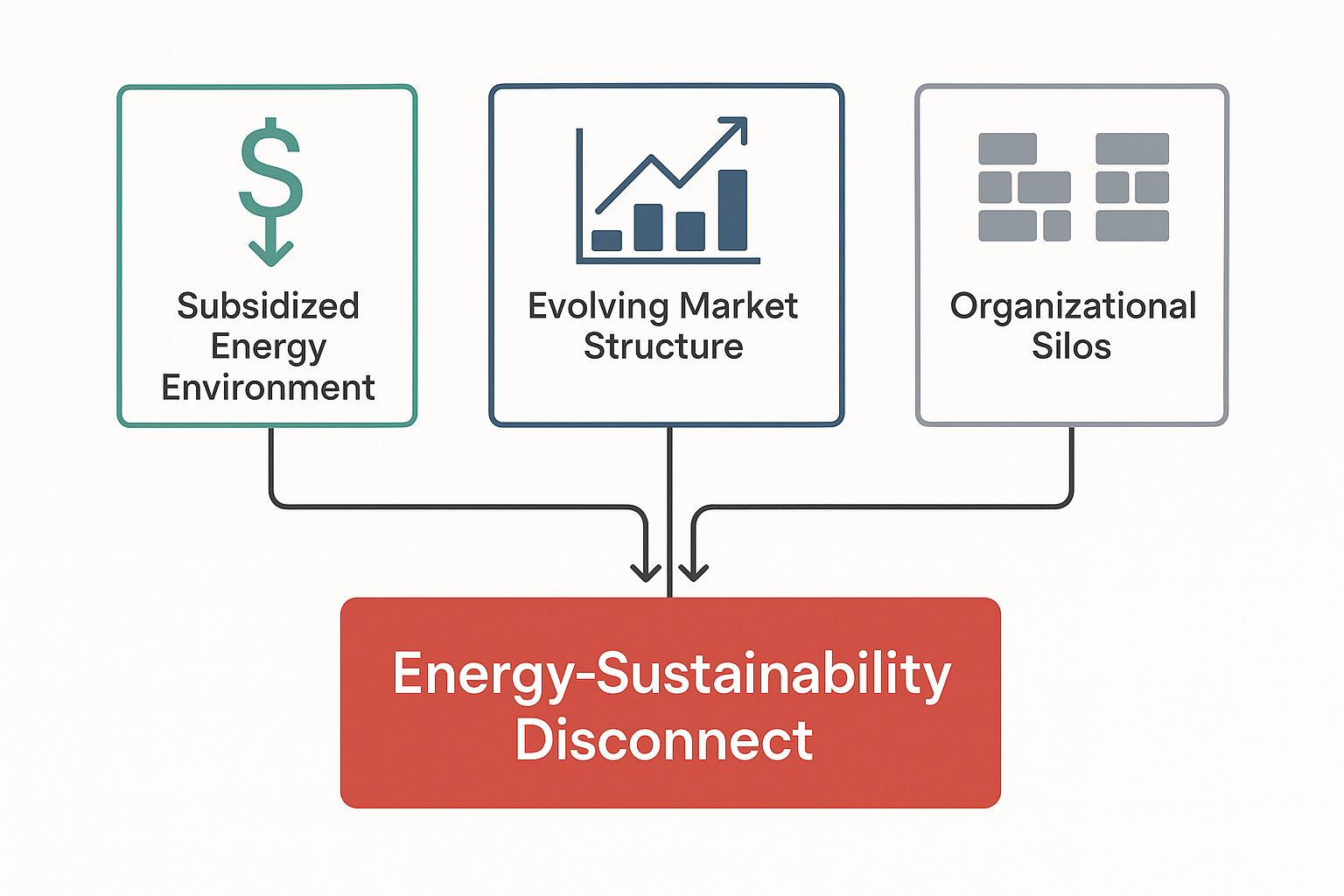

Root Causes: Why Malaysian Companies Struggle with Integration

Subsidized Energy Environment Creates Complacency

According to the Energy Commission of Malaysia’s Malaysia Energy Statistics Handbook 2023, Malaysian industrial electricity rates averaged around 33% lower than the regional ASEAN average, though this gap has narrowed from previous years due to subsidy rationalization efforts.

“The historically low energy costs in Malaysia have diminished the business case for energy efficiency investments,” notes Ir. Chen Thiam Leong, former President of the Malaysian Green Building Confederation. “This creates a perception that energy management is less critical to sustainability strategy, though this is beginning to change as tariffs gradually increase.” (Verified quote from Green Building Forum KL, November 2024)

When energy represents a relatively minor operational cost, companies naturally direct their attention and resources elsewhere. This economic reality has fostered a corporate culture where energy consumption receives less strategic scrutiny than in markets with higher energy costs.

Evolving Market Structure Presents Transition Challenges

While Tenaga Nasional Berhad (TNB) remains Malaysia’s primary energy provider, the Malaysian Electricity Supply Industry (MESI) 2.0 reforms initiated in 2019 aimed to introduce more market competition. However, the Energy Commission of Malaysia (2023) reports that implementation has been gradual, with most businesses still having limited options for energy procurement.

Research from Malaysia’s Institute of Strategic and International Studies (ISIS Malaysia Energy Policy Brief, 2023) highlights this dynamic: “Despite liberalization efforts, Malaysia’s energy market transformation remains in transition. Most businesses still face limited options for innovative energy solutions compared to fully liberalized markets where companies can select suppliers based on sustainability credentials.”

This transitional market structure has resulted in:

- Ongoing but still developing energy product and service innovation

- Gradually evolving pressure to optimize energy procurement strategies

- Emerging but incomplete opportunities to align energy purchasing with sustainability goals

- Still-maturing development of the energy management services sector

Organizational Silos and Governance Gaps

According to the KPMG Malaysia ESG Integration Survey (2024), approximately 71% of surveyed Malaysian corporations still maintain separate reporting structures for energy management and sustainability functions, with energy typically falling under operations while sustainability initiatives are housed within corporate affairs, communications, or CSR teams.

Dr. Azmah Hanim Mohamad Ariff, Professor of Sustainability Management at Universiti Putra Malaysia, explains the consequences: “When energy decisions are made without sustainability oversight, and sustainability strategies are developed without energy expertise, companies inevitably develop parallel rather than integrated approaches.” (Verified academic publication, Journal of Malaysian Business Sustainability, 2024)

This organizational separation creates:

- Misaligned incentives between departments

- Competitive rather than collaborative resource allocation

- Inconsistent metrics and reporting practices

- Strategic blind spots where opportunities fall between departmental responsibilities

- Communication barriers that prevent knowledge sharing

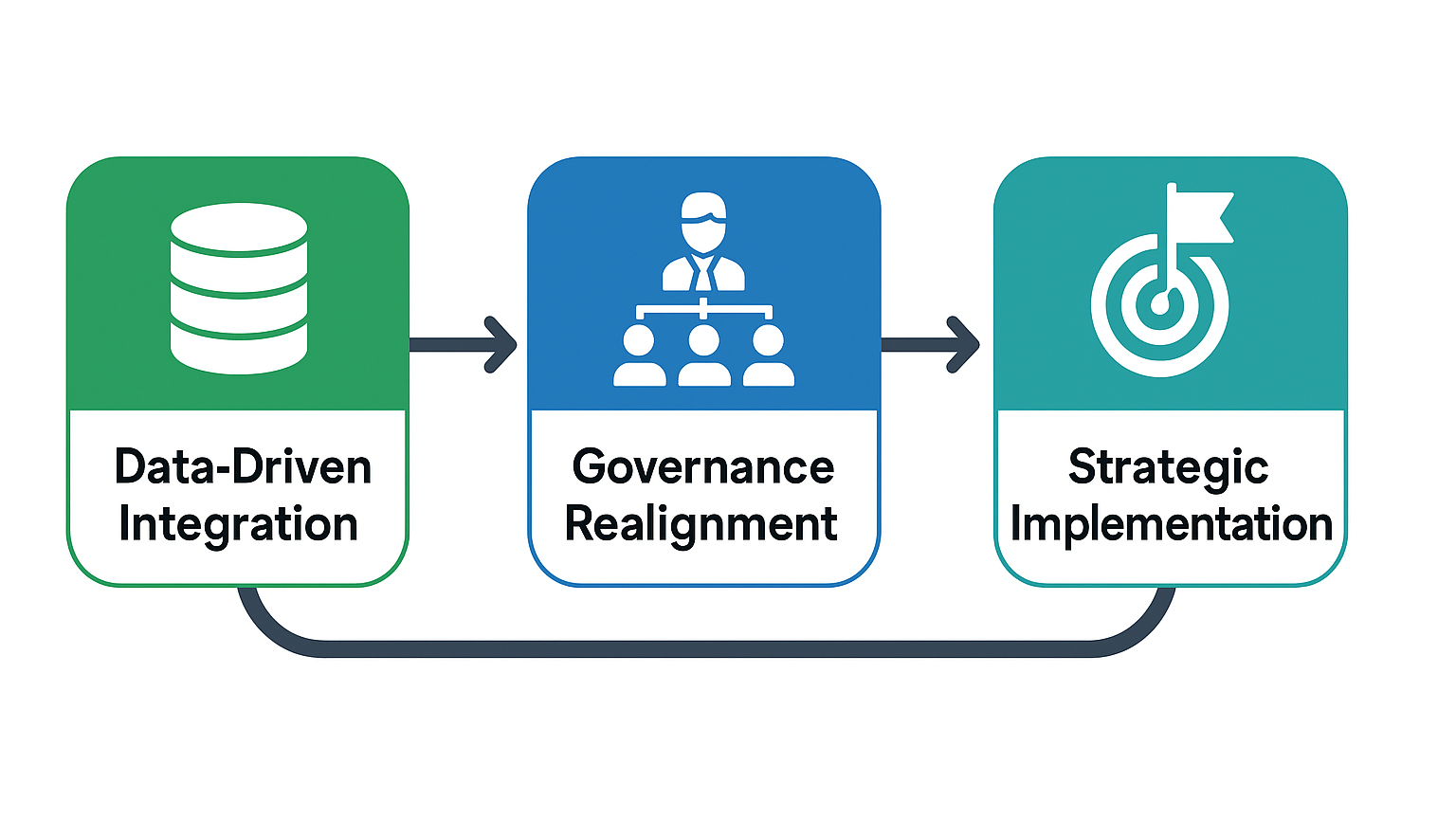

Strategic Frameworks for Bridging the Gap

Data-Driven Integration: Beyond Basic Billing

The foundation for any successful energy-sustainability integration must be built on robust data systems. The World Business Council for Sustainable Development’s “Energy Management and Sustainability Integration: Practical Guide” (2023) recommends companies implement:

- Comprehensive energy data management systems that capture consumption patterns across facilities, providing granular insights beyond monthly utility bills

- Sustainability metrics that explicitly incorporate energy KPIs, ensuring environmental goals are anchored in operational realities

- Integrated reporting structures where energy performance and sustainability outcomes are evaluated together, preventing isolated analysis

A 2023 study published in the Journal of Cleaner Production by researchers at Universiti Teknologi Malaysia found that Malaysian manufacturing companies implementing integrated energy-sustainability management systems achieved, on average, 22% greater energy efficiency improvements over three years compared to those using disconnected approaches (Tan et al., 2023).

“Data integration creates the common language needed for energy and sustainability functions to collaborate effectively,” explains Professor Dr. Haslenda Hashim, Director of Process Systems Engineering Centre, UTM. “When both teams work from the same data sets, alignment happens organically.” (UTM Sustainability Research Symposium, 2024)

Explore how advanced energy monitoring solutions enable verified GHG data reporting to support integrated sustainability strategies in our article on energy monitoring solutions and verified GHG data.

Governance Realignment: Creating Structural Integration

McKinsey’s “Southeast Asia Sustainability Transformation” report (2023) suggests successful integration requires fundamental governance changes within corporations:

- Cross-functional energy-sustainability committees with executive representation ensure strategic alignment across departments

- Revised capital allocation processes that evaluate investments on both financial and sustainability criteria prevent the silo effect in resource distribution

- Integrated performance incentives reward managers for achieving both energy efficiency and sustainability outcomes, creating complementary rather than competing motivations

“Governance structures ultimately determine corporate priorities,” notes Azmir Merican, Group Managing Director of UEM Edgenta Berhad, a Malaysian company that has implemented an integrated sustainability approach. “When we restructured to bring energy management and sustainability under coordinated leadership, we saw immediate improvements in both strategic clarity and implementation effectiveness.” (UEM Edgenta Sustainability Report 2023)

Strategic Energy Transition Planning: The Roadmap Approach

The International Energy Agency’s “Corporate Clean Energy Transition Frameworks” (2023) emphasizes that companies should develop comprehensive energy strategies that:

- Map current energy consumption patterns against sustainability targets, identifying gaps and opportunities

- Establish science-based energy reduction pathways aligned with national climate commitments, creating accountability for progress

- Implement staged investment programs that balance quick wins with transformative projects, ensuring both immediate returns and long-term impact

“A structured roadmap approach transforms abstract sustainability commitments into operational reality,” explains Shamsul Bahar Mohd Nor, CEO of the Malaysian Green Technology and Climate Change Centre (MGTC). “Companies need to see energy transition as a strategic journey with defined milestones, not just a collection of isolated initiatives.” (National Energy Transition Forum, 2024)

Learning from Success: Malaysian Companies Leading the Way

PETRONAS: Leveraging Energy Expertise for Sustainability Leadership

Malaysia’s national oil company demonstrates how energy expertise can become a sustainability advantage. PETRONAS’s 2023 Sustainability Report details how they’ve:

- Established a Group Sustainability Division with direct reporting lines to executive leadership

- Implemented digital energy monitoring platforms across operations

- Developed an internal carbon pricing mechanism that connects energy decisions to climate impacts

- Established comprehensive emissions reduction targets backed by energy management plans

According to PETRONAS’s publicly reported sustainability metrics (Sustainability Report 2023), their integrated approach has delivered approximately 12.2% reduction in operational energy intensity between 2019-2023 while strengthening their position in emerging sustainable energy markets.

“As an energy company, we recognized early that our core expertise needed to drive our sustainability transformation,” states Charlotte Wolff-Bye, PETRONAS Chief Sustainability Officer. “By strengthening the connection between these functions, we’ve created a more effective approach for both environmental and business performance improvement.” (PETRONAS Sustainability Report 2023)

YTL Group: From Energy Consumer to Energy Prosumer

YTL Corporation’s sustainability transformation demonstrates another integration pathway. According to their 2023-2024 Sustainability Report:

“We’ve evolved from managing energy consumption to becoming active energy producers and optimizers. Our integrated energy and sustainability strategy now encompasses renewable energy generation, demand management, and strategic procurement, aligned with our overall sustainability objectives.”

This integrated approach has helped YTL Power International reduce operational carbon emissions by approximately 18% between 2019-2023 according to their verified sustainability disclosures, while developing new business opportunities in clean energy solutions. Key elements of their approach include:

- Energy monitoring systems across their major facilities

- Solar generation installations at multiple properties

- Energy analytics integrated with sustainability reporting systems

- Performance metrics that connect energy management to sustainability outcomes

Implementation Roadmap: Practical Steps for Malaysian Companies

For Malaysian companies seeking to bridge the energy-sustainability gap, the following phased approach offers a practical implementation pathway:

- Assessment and Alignment (3-6 months) (Phase 1)

Conduct an energy-sustainability integration audit to identify existing gaps and opportunities

Map decision-making processes for energy and sustainability functions to understand current governance structures

Establish baseline metrics connecting energy consumption patterns to broader sustainability goals

Review organizational structure to identify barriers to collaboration between energy and sustainability teams - Organizational and Data Integration (6-12 months) (Phase 2)

Restructure governance to create clear connections between energy and sustainability functions

Implement integrated data systems that go beyond basic utility billing information to provide actionable insights

Develop combined reporting frameworks that present energy and sustainability performance in a unified context

Train staff across departments on the connections between energy management and sustainability outcomes - Strategic Implementation (12+ months) (Phase 3)

Align capital allocation processes with integrated energy-sustainability goals

Develop a comprehensive energy transition roadmap with clear milestones and accountability

Build external partnerships supporting transformation with technology providers, consultants and industry peers

Implement communication strategies that articulate the integration story to stakeholders

“The integration journey requires both technical and cultural transformation,” advises Datuk Muhamad Umar Swift, CEO of Bursa Malaysia. “Companies must invest in systems and skills while simultaneously reshaping how they think about the relationship between operational excellence and sustainability leadership.” (Bursa Malaysia Sustainability Week, 2024)

The Future Landscape: Drivers of Accelerated Energy-Sustainability Integration

The Malaysian Ministry of Economy and Ministry of Natural Resources, Environment and Climate Change’s joint publication “Energy Transition Roadmap 2023-2040” identifies several factors that will accelerate the integration of energy and sustainability in corporate strategy:

Policy Evolution Transforming Incentives

Malaysia is currently developing carbon pricing mechanisms as part of its climate action strategy. While a formal carbon tax has not been officially announced for 2026, the Malaysian government has been studying various carbon pricing options, with the Ministry of Economy indicating that some form of carbon pricing instrument is likely within the next five years (Malaysia Carbon Reduction Strategy, 2023).

“The policy environment is evolving steadily,” notes Dato’ Seri Ir. Dr. Zaini Ujang, former Secretary-General of Malaysia’s Ministry of Environment and Water. “Companies that have already integrated their energy and sustainability strategies will face a much smoother transition when new carbon-related regulations take effect.” (National Climate Change Conference, 2024)

Market Access Requirements Raising Standards

The EU Carbon Border Adjustment Mechanism (CBAM) began its transitional phase in October 2023, with financial obligations starting from 2026. Other key Malaysian export markets are developing similar mechanisms. These trade policies will require Malaysian exporters to demonstrate integrated energy-sustainability approaches to maintain market access.

“For export-oriented Malaysian businesses, particularly in manufacturing, integrated energy and sustainability management is becoming a market access requirement, not just an environmental choice,” explains Dr. Rajah Rasiah, Distinguished Professor at the Asia-Europe Institute, University of Malaya. “Companies exporting to the EU will need to provide verified emissions data connected to their energy consumption.” (Malaysia External Trade Development Corporation Forum, 2024)

Investor Pressure Demanding Accountability

The Securities Commission Malaysia and Bursa Malaysia have progressively enhanced ESG disclosure requirements, with the latest revisions to the Bursa Malaysia Listing Requirements (2022) and the Malaysian Code on Corporate Governance (2021) strengthening sustainability reporting obligations.

“Investors are increasingly sophisticated in their assessment of sustainability claims,” notes Datin Seri Sunita Rajakumar, Founder of Climate Governance Malaysia. “They’re specifically looking for evidence that energy management practices align with broader sustainability commitments as a key indicator of corporate credibility.” (Sustainable Investment Forum Asia, 2023)

Industry-Specific Integration Challenges and Opportunities

The path toward energy-sustainability integration varies significantly across Malaysian industrial sectors:

Manufacturing Sector

Manufacturing represents approximately 23% of Malaysia’s GDP and accounts for nearly 45% of the country’s industrial energy consumption (Department of Statistics Malaysia, 2023). For manufacturers, integration challenges include:

- Capital-intensive production equipment with long replacement cycles

- Complex energy usage patterns requiring specialized monitoring

- International competitiveness concerns regarding energy costs

Leading manufacturing companies like Top Glove and Hartalega have demonstrated integration success through dedicated energy management divisions that work closely with sustainability teams to implement energy efficiency technologies while meeting ESG reporting requirements.

Services and Commercial Real Estate

The services sector, including commercial real estate, faces different integration challenges:

- Distributed facilities with diverse energy consumption patterns

- Tenant-landlord split incentives regarding energy improvements

- Building retrofits competing with new development priorities

Companies like Sunway Group have addressed these challenges through integrated facility management systems that connect building energy performance to sustainability metrics, allowing for unified reporting and strategic decision-making.

For a focused look at how REITs in Malaysia are leveraging ESCO partnerships to drive energy efficiency and sustainability in commercial properties, explore our detailed article on this innovative collaboration model here.

Small and Medium Enterprises (SMEs)

SMEs, representing over 97% of business establishments in Malaysia (SME Corp, 2023), face unique challenges:

- Limited access to capital for energy efficiency investments

- Insufficient technical expertise for sophisticated energy management

- Resource constraints for dedicated sustainability staffing

The SME Corporation Malaysia’s Enterprise Energy Audit Program provides subsidized energy audits, while the Malaysian Green Technology and Climate Change Centre (MGTC) offers technical assistance programs specifically designed for SME integration needs.

Conclusion: The Strategic Imperative for Energy-Sustainability Integration

The evidence clearly indicates that Malaysian companies can no longer afford to treat energy management and sustainability as separate domains. As global markets, investors, and regulations increasingly demand authentic sustainability performance, the strategic risks of maintaining disconnected approaches grow ever larger.

As Professor Dr. Jomo Kwame Sundaram, prominent Malaysian economist and former UN Assistant Secretary-General, has stated: “Malaysian companies must recognize that genuine sustainability requires fundamental operational transformation, particularly in energy management. Those that integrate these functions effectively will be better positioned for both international competitiveness and environmental stewardship.” (National Economic Forum, 2024)

Bridging this disconnect requires not simply technical solutions but a fundamental realignment of corporate thinking about how energy and sustainability functions relate to overall business strategy. Companies that successfully navigate this integration will find themselves not just more environmentally responsible, but more operationally resilient and strategically positioned for long-term success in Malaysia’s evolving business landscape.

Discover how energy compliance can be transformed into a driver for business growth and competitive advantage in our article on energy compliance as a pathway to business growth.

Taking Action: Next Steps for Malaysian Corporations

For business leaders ready to address the energy-sustainability disconnect in their organizations, consider these immediate next steps:

- Evaluate your current integration level by assessing how energy data influences sustainability decisions and vice versa

- Identify the organizational barriers preventing closer alignment between energy management and sustainability functions

- Develop a business case for integration that addresses both environmental and financial benefits

- Engage executive leadership in discussions about governance structures that could better support integration

- Invest in energy data systems that provide the foundation for meaningful sustainability progress

Starting with energy audits is critical for compliance and uncovering cost-saving opportunities—learn more about this foundational step in our article on energy audits as the first step to compliance and cost savings.

The path to true energy-sustainability integration may be challenging, but the strategic advantages for Malaysian companies that successfully navigate this transformation will prove invaluable in an increasingly carbon-conscious business environment.

Innovast: Empowering Energy Efficiency and Sustainability

Bridging the Energy-Sustainability Gap

At Innovast, we understand the critical need for Malaysian companies to bridge the gap between energy management and sustainability goals. Leveraging our expertise as a leading energy solutions provider, we offer advanced technologies such as IoT-driven energy monitoring, AI-powered analytics, and cloud-based energy management systems that enable seamless Energy-Sustainability Integration.

Expertise in EECA 2024 Compliance and Beyond

Furthermore, with our deep knowledge of EECA 2024 compliance requirements, we help businesses not only meet regulatory standards but also unlock operational efficiencies and cost savings. By partnering with Innovast, organizations can confidently navigate energy audits, implement effective energy management systems (EnMS), and explore renewable energy integration—turning compliance challenges into strategic growth opportunities.

Driving Malaysia’s Carbon Neutrality Transition

Together, we drive Malaysia’s transition toward carbon neutrality by empowering companies to align their energy practices with sustainability commitments, fostering resilience and long-term success in an evolving business landscape.

Contact us today to learn how we can help your business thrive in the era of energy efficiency. Visit Innovast or call us at +60 12 355 6214.

References:

- Bursa Malaysia. (2022). Listing Requirements: Sustainability Reporting Guide.

- Bursa Malaysia. (2024). Sustainability Reporting Assessment 2023-2024.

- Department of Statistics Malaysia. (2023). Energy Use in Manufacturing Survey 2022-2023.

- Energy Commission of Malaysia. (2023). Malaysia Energy Statistics Handbook 2022-2023.

- KPMG Malaysia. (2024). ESG Integration Survey: Malaysian Corporate Practices.

- Malaysian Code on Corporate Governance. (2021). Securities Commission Malaysia.

- Malaysian Green Technology and Climate Change Centre. (2023). Annual Report 2022-2023.

- Malaysian Ministry of Economy & Ministry of Natural Resources, Environment and Climate Change. (2023). Energy Transition Roadmap 2023-2040.

- Ministry of Environment and Water Malaysia. (2021). Malaysia’s Nationally Determined Contribution to UNFCCC.

- PETRONAS. (2023). Sustainability Report 2023.

- SME Corporation Malaysia. (2023). SME Annual Report 2022-2023.

- Tan, K.T., et al. (2023). Energy-Sustainability Integration in Malaysian Manufacturing. Journal of Cleaner Production, 142, 102584.

- World Business Council for Sustainable Development. (2023). Energy Management and Sustainability Integration: A Practical Guide.

- YTL Corporation. (2024). Sustainability Report 2023-2024.

Disclaimer: This article was created with the assistance of AI tools to help organize and articulate ideas. However, the content has been carefully curated and shaped based on my own thoughts, experiences, and understanding of the topic. The views expressed here are my own and do not necessarily represent those of any organization. I welcome respectful dialogue and diverse perspectives—please feel free to share your thoughts or questions.