Energy Service Companies (ESCOs) have emerged as critical partners for Real Estate Investment Trusts (REITs) seeking to improve energy efficiency, reduce operational costs, and enhance environmental sustainability. This article examines the significant advantages of ESCO partnerships for REITs in global markets, with special attention to the Asian region and Malaysia specifically. The evidence indicates that ESCO-REIT collaborations are indeed able to deliver substantial financial returns through guaranteed energy savings. This is, of course, in addition to providing technical expertise without significant upfront capital, and helping REITs align with increasingly stringent regulatory requirements and ESG expectations.

Understanding ESCOs and Their Core Services

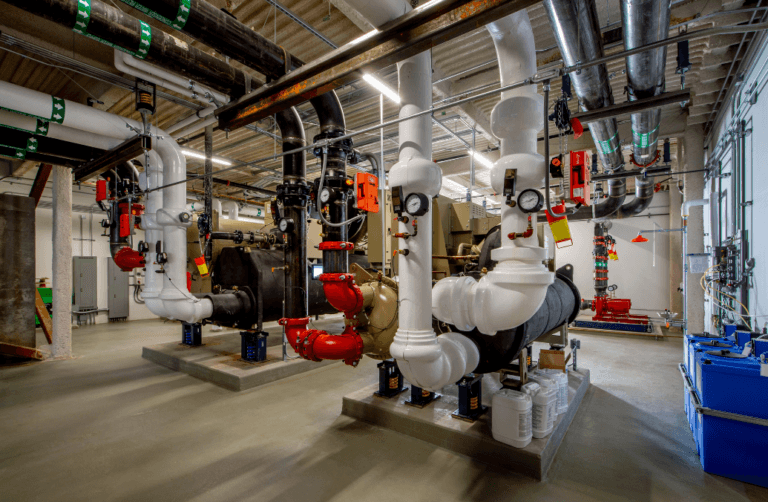

ESCOs, or Energy Service Companies, operate under a specialized business model providing comprehensive energy saving services to building owners through performance-based contracts. These companies offer a full spectrum of energy efficiency solutions, including detailed energy audits for facilities, design and implementation of energy-saving measures, ongoing maintenance and operation management of installed equipment. This also often includes financing the entire project for the client[1]. The defining characteristic of ESCO operations is their energy savings guarantee, creating a low-risk, capital-free proposition for property owners and managers.

The ESCO business model has matured significantly since its inception in the late 1970s, evolving into a widely accepted and reliable approach to energy improvements[2]. Today’s ESCOs follow established industry standards and deploy proven energy-saving technologies with excellent track records for customer satisfaction. This expertise is particularly valuable for REITs, which manage diverse property portfolios with varying energy efficiency challenges and opportunities.

Energy Performance Contracting Fundamentals

Energy Performance Contracting (EPC) represents the core mechanism through which ESCOs engage with clients like REITs. Under this arrangement, the fundamental funding principle requires that accumulated savings over the contract life equal or exceed the total project cost, including financing expenses[3]. This structure allows REITs to implement energy efficiency measures without diverting capital from their core business activities.

Performance contracts come in several forms, with the two most common being the guaranteed savings model and the shared savings model. The guaranteed savings approach establishes a minimum level of energy savings that must be achieved, with the ESCO bearing the risk of underperformance[4]. Alternatively, the shared savings model distributes the actual cost reductions between the ESCO and property owner according to predetermined ratios, commonly 80:20 or 75:25 in Malaysian implementations[3].

General Benefits of ESCO Partnerships for REITs

Financial Advantages and Risk Mitigation

One of the most compelling advantages for REITs in partnering with ESCOs is the ability to implement energy efficiency improvements without significant upfront capital expenditure. This approach allows REITs to redirect investment toward core business activities while still capturing operational savings. Most buildings realize energy savings of 15-35% through ESCO-implemented projects, significantly reducing operational expenses over time[2].

The performance-based nature of ESCO contracts provides REITs with substantial risk protection. Since ESCOs guarantee specific levels of energy savings, they assume the technical and performance risks associated with the implemented measures[4]. This risk transfer is particularly valuable for REITs, which must maintain consistent returns for investors and may be reluctant to assume additional operational uncertainties.

Enhanced Asset Performance and Valuation

ESCO partnerships frequently lead to updating or replacing outdated equipment with newer, more efficient technologies. These improvements result in higher-quality building systems with fewer breakdowns and reduced maintenance costs[2]. For REITs, these enhancements translate to improved tenant satisfaction through better lighting, air quality, and temperature control-factors that can reduce tenant turnover and potentially command premium rental rates.

The implementation of energy efficiency measures often increases property values within REIT portfolios. Buildings with lower operational costs and better sustainability credentials typically achieve higher valuations in the market, benefiting REIT shareholders through both improved distributions and capital appreciation.

ESG Compliance and Reporting Advantages

As environmental, social, and governance (ESG) considerations increasingly influence investor decisions, REITs face growing pressure to demonstrate sustainability commitments. ESCO partnerships provide a systematic approach to improving environmental performance, with measurable outcomes that can be reported to stakeholders[5]. For listed REITs, this data supports compliance with emerging sustainability reporting requirements being implemented by regulatory bodies globally.

The case of Hektar REIT in Malaysia exemplifies this benefit, as the trust received gold awards for its ESG initiatives, which included energy efficiency programs that simultaneously reduced its carbon footprint and operational costs[5]. Such recognition enhances brand value and investor confidence in the REIT’s long-term sustainability strategy.

ESCO Partnerships in the Asian Context

The Dominant Regional Market

Asia represents the center of gravity for the global ESCO industry, accounting for approximately 60% of worldwide ESCO revenues[6]. Of the USD 26.8 billion global ESCO market in 2016, an impressive USD 15.1 billion was generated in China alone, with an additional USD 300 million in India and significant activity in Japan, Korea, Hong Kong, Singapore, and other Southeast Asian markets[6]. This regional concentration indicates both the maturity of the ESCO model in Asia and the substantial opportunity for REITs operating in these markets.

The formation of the Asia-Pacific ESCO Industry Alliance further strengthens the regional ecosystem, providing platforms for knowledge exchange, capacity development, and business matching[6]. This collaborative approach helps standardize best practices and creates more transparent markets for energy performance contracting, benefiting REITs seeking qualified ESCO partners.

Alignment with Regional Carbon Reduction Goals

Many Asian countries have established ambitious carbon reduction targets, requiring significant improvements in building energy efficiency. REITs with properties in these jurisdictions can leverage ESCO partnerships to align with national sustainability roadmaps while maintaining financial performance. For example, Malaysia’s commitment to achieving net-zero carbon emissions by 2050 requires substantial transformation in the real estate sector[7].

The integration of renewable energy systems represents another growing opportunity for ESCO-REIT collaboration in Asia. Energy sector forecasts for Malaysia indicate that solar PV’s share in total installed power generation capacity will grow from 12% in 2025 to 58% by 2050[7]. ESCOs can help REITs navigate this transition by designing and implementing on-site renewable energy solutions that complement energy efficiency measures.

Malaysia: A Case Study for ESCO-REIT Collaboration

Regulatory Support and Incentives

Malaysia provides significant institutional support for ESCO-REIT partnerships through programs like the Energy Audit Conditional Grant (EACG 2.0) under the 12th Malaysia Plan (2021-2025)[8]. These grants enable commercial building owners, including REITs, to collaborate with locally registered ESCOs to conduct energy audits and implement recommended measures. This government backing reduces project costs and accelerates the adoption of energy-efficient technologies.

The upcoming implementation of the Energy Efficiency and Conservation Act (EECA) in January 2025 will establish new building energy efficiency standards in Malaysia[7]. REITs can proactively address these requirements through ESCO partnerships, ensuring compliance while capturing operational savings. Similarly, BURSA Malaysia’s new Sustainability Reporting Requirements increase accountability for listed companies, including REITs, making systematic energy management increasingly important[7].

Demonstrated Success in Malaysian Properties

Case studies from Malaysian ESCO projects illustrate the potential benefits for REITs. One documented example showed a reduction in monthly electricity costs from approximately RM 520,000 to achieve actual shared savings of around RM 74,000 per month for the client under a 7-year contract with an 80:20/75:25 sharing ratio[3]. Another case demonstrated monthly savings of approximately RM 98,000 from a baseline electricity bill of RM 1 million[3].

The Treasury Building at the Ministry of Finance of Malaysia achieved a 17% reduction in electricity consumption in 2011 compared to its 2010 baseline through ESCO-implemented measures[3]. These examples demonstrate that significant operational savings are achievable in Malaysian properties through well-structured ESCO partnerships.

Tailored Approaches for Malaysian REITs

Malaysian REITs can benefit from ESCOs’ ability to customize energy efficiency strategies for different property types. For retail-focused REITs like Hektar REIT, which received recognition for its energy initiatives[5], ESCOs can implement solutions addressing the unique energy demands of shopping centers, including lighting, HVAC, and refrigeration systems. Office and industrial REITs similarly benefit from sector-specific expertise.

The local ESCO market in Malaysia understands the specific challenges of the tropical climate, including high cooling demands and humidity management. This regional expertise ensures that energy efficiency measures are appropriate for local conditions and deliver optimal performance for REIT properties in the Malaysian context.

Conclusion

ESCO partnerships offer REITs globally, in Asia, and specifically in Malaysia, a strategically advantageous approach to improving energy efficiency, reducing operational costs, and enhancing ESG performance. The performance-based contracting model eliminates most financial risks while delivering guaranteed energy savings, making it particularly suitable for REITs seeking to maximize investor returns while improving sustainability credentials.

The mature ESCO market in Asia, backed by supportive policy frameworks in countries like Malaysia, provides REITs with access to experienced partners capable of delivering comprehensive energy efficiency solutions. As regulatory requirements and investor expectations regarding sustainability continue to strengthen, ESCO-REIT collaborations represent a proven pathway to achieving both environmental and financial objectives concurrently.

For REITs considering energy efficiency initiatives, ESCOs offer the compelling combination of technical expertise, performance guarantees, and financing options that can transform property portfolios without significant capital outlay or operational disruption. This win-win approach positions forward-thinking REITs for long-term success in an increasingly carbon-conscious and energy-efficient real estate market.

How Innovast Can Help REITs Achieve Energy Efficiency and Compliance

As a leading Energy Service Company (ESCO) in Malaysia, Innovast specializes in delivering tailored energy efficiency solutions that empower Real Estate Investment Trusts (REITs) to optimize operations, reduce costs, and enhance sustainability. With a proven track record and cutting-edge technology, Innovast is your trusted partner for achieving energy efficiency, regulatory compliance, and ESG excellence.

Our Key Services:

- Comprehensive Energy Audits: Identify inefficiencies and uncover actionable Energy Saving Measures (ESMs) to reduce energy consumption and costs.

- Energy Performance Contracting (EPC): Implement energy-saving upgrades with no upfront costs, repaid through guaranteed energy savings, ensuring a risk-free approach to efficiency.

- InnoSense EMS Platform: A cloud-based energy monitoring and analytics tool that provides real-time insights, predictive analytics, and automated compliance reporting for EECA and Bursa Malaysia requirements.

- Sustainability Consulting: Align your portfolio with green building certifications like LEED, GBI, and GreenRE while enhancing your ESG profile.

Why Choose Innovast?

- Guaranteed Energy Savings: Our performance-based contracts ensure measurable results, reducing operational costs by up to 35%.

- Regulatory Expertise: We simplify compliance with EECA 2024 and Bursa Malaysia Sustainability Reporting, helping you avoid penalties and meet stakeholder expectations.

- Tailored Solutions: From retail-focused REITs to industrial and office properties, our strategies are customized to meet the unique energy demands of your portfolio.

- Proven Results: Innovast has helped clients achieve significant energy savings, enhanced asset value, and improved tenant satisfaction.

Take the First Step Towards Smarter Energy Management

Partner with Innovast to transform your energy management strategy and position your REIT for long-term success in an increasingly energy-conscious market.

Contact us today to schedule a free consultation or energy audit and discover how Innovast can help you achieve your energy efficiency and sustainability goals.

Learn More About Innovast | Contact Us

- https://www.jelsystem.co.jp/en/blog1/

- https://www.dnr.louisiana.gov/page/benefits-of-performance-contracting

- https://ibfimonline.com/wp-content/uploads/2020/09/EE-Sector-Role-of-MAESCO-in-Developing-Financially-Viable-EE-Project-by-MAESCO.pdf

- https://ivypanda.com/essays/energy-service-companies-benefits-and-drawbacks/

- https://theedgemalaysia.com/node/691232

- https://www.pe2.org/news/60-global-esco-market-asia-asia-pacific-esco-industry-alliance

- https://www.jll.com.my/en/trends-and-insights/research/malaysia-s-real-estate-embraces-esg-on-path-to-net-zero-2050

- https://www.seda.gov.my/energy-demand-management-edm/energy-audit-conditional-grant-commercial-building/

1 thought on “Benefits of ESCO Partnerships for REITs: Global, Asian, and Malaysian Perspectives”

Pingback: Energy-Sustainability Integration: Bridging the Gap in Malaysian Corporate Strategy